Strict regulations. Newly emerging and rapidly evolving technologies. Advancing competitors. Increasingly demanding customers. These challenges occupy a large part of the strategic horizon of financial organizations. Human capital and time resources are often insufficient to drive the development of existing products. What’s left for the need to explore and implement innovative solutions?

This article discusses the advantages and practical uses of IT outsourcing in the financial industry. Furthermore, we review some sensational digital trends in the sector along with accompanying statistics.

A Strategic Opportunity – The Role of Information Technology in Financial Services

Various Models and Services for Elevated Agility and Efficiency

IT outsourcing offers financial companies various collaboration models that provide swift access to specialized expertise, cutting-edge technologies, and essential services. A strategic partnership with the right service provider can significantly streamline in-house IT operations by addressing knowledge and skill gaps and making the team’s work more efficient. This can accelerate work on specific software development projects and reduce time-to-market. Seasoned and senior remote team members can add value to the workflow by sharing technical expertise and business know-how with the company’s in-house team, augmenting the overall capabilities of the financial institution.

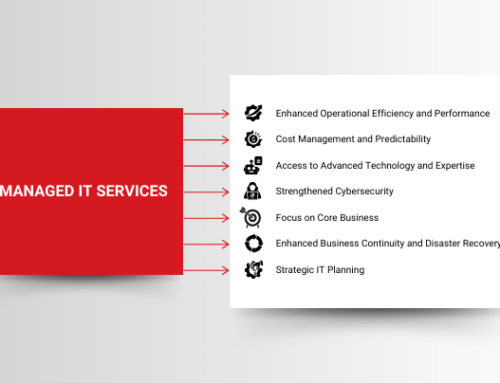

A major benefit of IT outsourcing is that it empowers financial services companies with the capacity to not only catch up with the latest technology trends but also leverage them to introduce innovations faster and gain a competitive advantage.

Enhanced Value for the Internal IТ Department

A financial company’s in-house IT team can tackle its day-to-day tasks more efficiently by distributing some of the workload to outsourced team members. Such collaboration allows for expanding an internal team’s capacity and technical expertise and creates conditions for scaling a financial business.

As an illustrative example, a large automotive finance provider turned to TSD for support in addressing the challenges related to the maintenance of its internal systems’ software development lifecycle. In response to growing business and technical needs, the company successfully expanded its IT department through the staff augmentation model.

TSD’s vast expertise in financial services software development led to the establishment of a fruitful and long-standing partnership. More details are available in the success story.

Round-the-Clock Utilization of Key Competencies

Financial companies have the valuable opportunity to benefit from the skills of outsourced IT staff even during non-working hours. This is possible when the IT vendor is strategically located in a convenient time zone that does not overlap with the time zone of the client or overlaps enough to allow for proper hand-off to remote team members. That enables the client to cover software development, testing, and support services within their in-house IT department at any time and achieve an uninterrupted cycle of financial systems maintenance and customer support.

As a result, information technology outsourcing helps financial organizations preserve business continuity and ensures that critical functions are monitored and maintained at all times.

Drastically Reduce Development and Monitoring Expenses

For a growing financial business with escalating technology needs, IT outsourcing is also a method of cutting operational costs while at the same time scaling capacity. These expenses encompass the overheads related to personnel recruiting, onboarding, and training, taxes, office and technical equipment, employee benefits and perks, etc.

For instance, one of our clients, a US-based lending services provider, optimized development and monitoring costs through an offshore staff augmentation partnership with TSD. We supported the company with the rich application development and system administration expertise of our IT professionals. You can learn more about the collaboration process and the achieved results in the case study.

Exploring New Frontiers with Customer Experience

Another area in which IT outsourcing can contribute is customer experience. End customers of financial services companies can benefit from timely enhanced, modernized, and more user-friendly financial software products with elevated quality of maintenance and customer support. Involving an outsourcing service provider in the development of financial software platforms helps to more easily tailor them to the requirements and preferences of business users through faster delivery and added value.

Mitigating the Risk of Cyberattacks

Another role of information technology in the financial services industry is protecting and storing sensitive information. For a company in this industry, cyber security may become a serious deal-breaker.

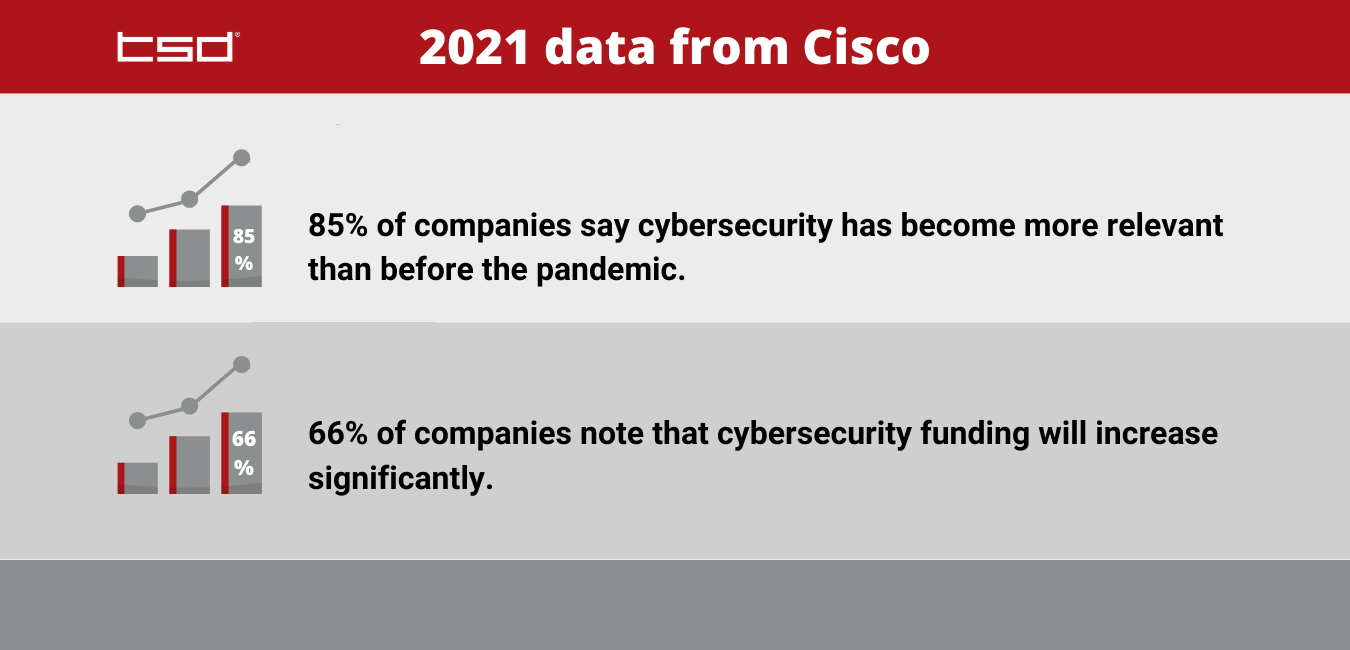

A 2021 data from Cisco highlights cybersecurity as one of the leading IT outsourcing trends. In their report, 85% of companies say cybersecurity has become even more relevant than before the pandemic. And 66% of companies note that cybersecurity funding will increase significantly. A NewtonX survey found that 56% of organizations now outsource up to a quarter of their cybersecurity staff.

Therefore, for financial services organizations, a partner with strict cybersecurity policies and relevant certifications is increasingly in demand.

IT Trends in the Financial Industry

Double Down on Process Automation and Artificial Intelligence

Financial companies are applying automation and artificial intelligence to improve the efficiency of their operations. The effect is felt both in the back-end and in customer interactions.

Automation takes the burden off repetitive processes and limits the number of manual errors. McKinsey claims that in approximately 60% of occupations, at least one-third of workday activities could be automated. One example of the added value of AI for financial businesses is the technology’s ability to process large volumes of data quickly and accurately to support critical decisions.

Financial Customers Are Becoming More Digital

Chatbots and virtual assistants are preferred real-time customer-business interaction tools. Through them, financial companies can provide instant responses to user inquiries and guide clients. That increases customer satisfaction as well as their engagement with the business.

As we previously touched upon, sensitive data protection is crucial for companies in the financial sector. Financial service customers understand the risks related to potentially endangering their data. And that is the main reason why financial companies increasingly invest in enhanced security.

Outsourcing – An Important Cost-Cutting Tool

Information technology outsourcing for financial services brings along a reduction in operating costs. Financial businesses achieve that with their partners’ help while they receive a high-quality service.

This method of cooperation gives them the flexibility to optimize the allocation of monetary and time resources. IT outsourcing is also a means of maintaining а continuity of business operations for finance companies.

Adopting an Advanced Cloud Strategy

In addition to providing invaluable services, an outsourcing partner can act as a trusted consultant in guiding financial institutions in the adoption of cloud services. Their role begins with introducing the financial entity to the concept of cloud infrastructure, which offers the flexibility to scale IT resources in alignment with specific requirements. This not only reduces but can eliminate the need for substantial upfront hardware investments.

Furthermore, an adept outsourcing company can facilitate the seamless migration of a client’s systems to the cloud. This strategic move ensures robust data security and compliance with stringent regulatory requirements, reinforcing the institution’s commitment to protecting sensitive information.

Regulatory Technology Compliance (RegTech)

Information technology plays a pivotal role in the financial services sector by introducing and implementing Regulatory Technology (RegTech) solutions. These cutting-edge solutions are designed to automate reporting processes, monitor transactions for any signs of suspicious activity, and ensure compliance with evolving regulatory requirements.

The financial services industry will continue its rapid development, and the benefits of IT outsourcing remain a key driver in facilitating the sustainable growth of businesses within the sector.

Get in touch with us today to discuss how we can respond to your needs and contribute to the success of your IT department through our extensive expertise in providing IT outsourcing solutions to financial services companies.

Leave A Comment